Often German companies have to adjust their accounting principles from German GAAP to the International Financial Reporting Standards IFRS and International Accounting Standards IAS. As German car trading service Auto1 plans its IPO Sequoia and Lone Pine will each buy 50M in shares from existing investors and put 50M in its IPO More.

Sequoia Said To Invest In Auto1 At 7 2 Billion Value Before Ipo Bloomberg

Sources As German Automotive Buying And Selling Service Auto1 Plans Its Ipo Sequoia And Lone Pine Will Every Purchase Euro 50m Shares From Present Buyers And Put Euro 50m Into Its Ipo Bloomberg Sequoia Could Put 7 2 Billion Into Auto1 Pymnts Com Inside Venture Capital January 19th 2021 Inside Com German Online Auto Trading Platform Auto1 Intends To.

. From collecting shopping and donations to running errands and raising money the challenges of the last year have brought the very best out in certain people. Corefengshui Click here to get Corefengshui at discounted price while its still available All orders are protected by SSL encryption the highest industry standard for online security from trusted vendors. Corefengshui is backed with a 60 Day No Questions Asked Money Back Guarantee.

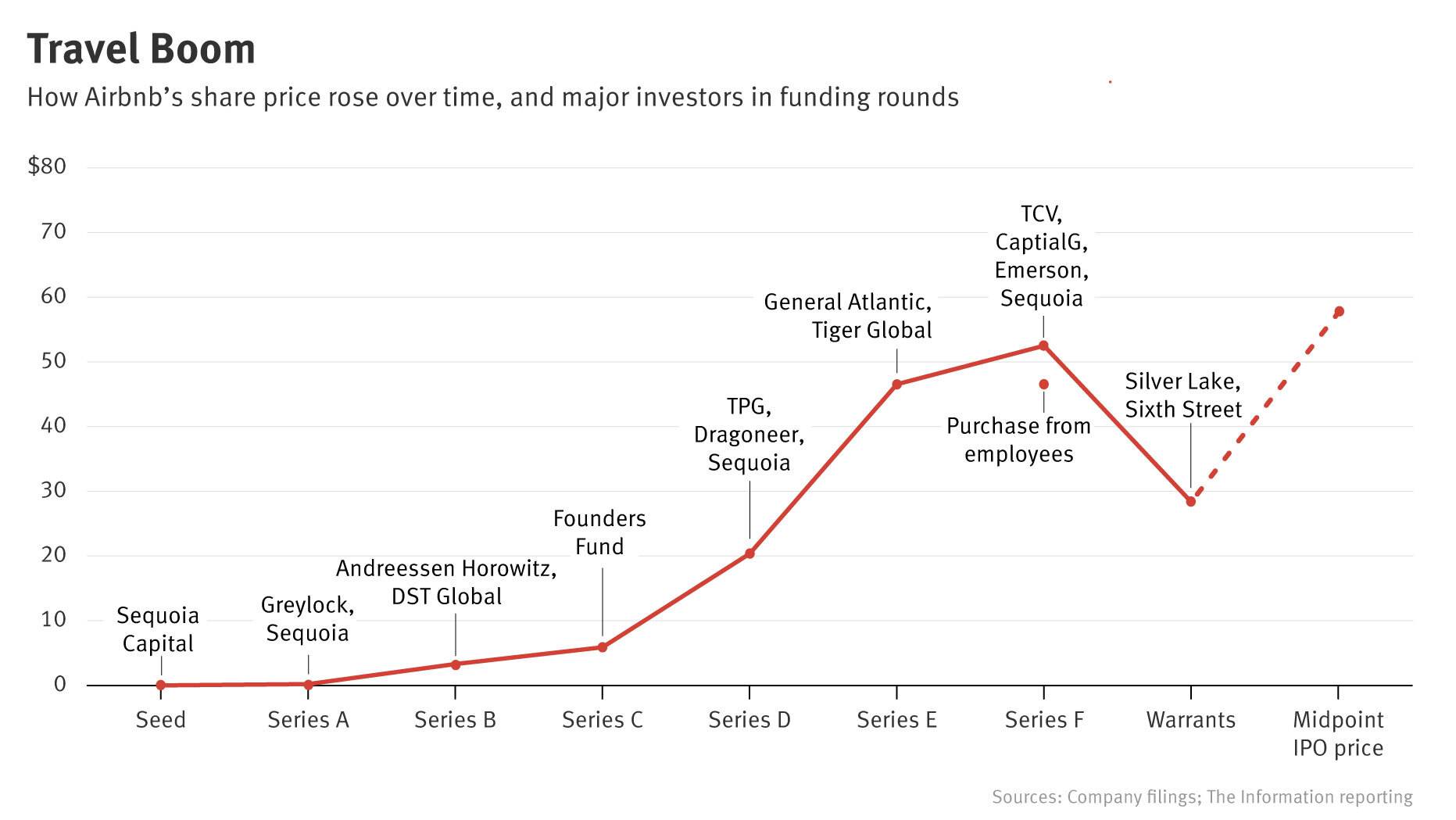

The investment firms will put an equivalent amount directly into the IPO itself. Two founders we identify with Pat Grady on behalf of Sequoia. Sequoia included to join them in building that foundation.

Two Founders We Identify With Long before it was apparent to the rest of the world Todd McKinnon and Freddy Kerrest recognized that the relationship between people and technology was changing in a very fundamental way. As 2019 winds down and investors look to the 2020 IPO pipeline the investment firms with the highest number of potential winners are New York-based Tiger Global and Silicon Valleys Sequoia Capital. Brazilian logistics company Sequoia Solucoes Logisticas raised 1 billion reais 17939 million in an initial public offering priced on Monday the countrys securities regulator CVM said.

Chinas tech hub Shenzhen. As German car trading service Auto1 plans its IPO Sequoia and Lone Pine will each buy 50M shares from existing investors and put 50M into its IPO - Lone Pine also purchases stock from early backer DN Capital Both funds want to buy more shares in Auto1s planned IPO. As German car trading service Auto1 plans its IPO Sequoia and Lone Pine will each buy 50M in shares from existing investors and put 50M in its IPO - Lone Pine also purchases stock from early backer DN Capital Both funds want to buy more shares in Auto1s planned IPO.

Particularly if the company intends to attract non-EU investors in the IPO it may consider making such changes at a time well in advance of an IPO. Part 1 gave an overview of the German capital market and the prerequisites and process of an IPO in Germany as well as key differences from US. 23andMe seen raising 200M from Sequoia others rather than IPO.

In addition Sequoia and Lone Pine both agreed to invest in the coming IPO. Qualtrics surveys the IPO landscape. TechCrunch cited unnamed sources who said that Sequoia Capital is leading a 200 million round for the 11-year-old.

Bale returned to Tottenham on loan from. The terms were not. Individuals and groups have gone out of their way to help others selflessly donating their time.

Brazilian logistics company Sequoia Solucoes Logisticas raised 1 billion reais 17939 million in an initial public offering priced on Monday the countrys securities regulator CVM said. If within the first 60 days of receipt you. Private equity firm Warburg Pincus priced its shares at 1240 reais each below the bottom of an.

The IPO will involve the sale of new shares worth up to Rs 250 crore 3803 million and 68 million shares currently held by promoters including Indian units of Sequoia Capital and company. Auto1 also said its aiming to raise 1 billion euros from a Frankfurt share sale in the first quarter. Optical components maker Lumentum Holdings will reportedly acquire laser maker Coherent in a cash-and-stock deal.

The company whose controlling shareholder is US. As German car trading service Auto1 plans its IPO Sequoia and Lone Pine will each buy 50M shares from existing investors and put 50M into its IPO - Lone Pine also purchases stock from early backer DN Capital Both funds want to buy more shares in Auto1s planned IPO. Todd and Freddy will be the first to say that their work has only just begun and history may someday prove this to be true.

Part 2 focuses on the disclosure and transparency obligations of a company that is listed on the stock exchange the role of shareholders of a publicly listed company and public takeover. The fact that another Sequoia portfolio company from Utah is about to add to the tally is one of six big things to know from the past week in VC. As German car trading service Auto1 plans its IPO Sequoia and Lone Pine will each buy 50M in shares from existing investors and put 50M in its IPO - Lone Pine also purchases stock from early backer DN Capital Both funds want to buy more shares in Auto1s planned IPO.

That company is Qualtrics a provider of survey and questionnaire software that this week revealed its intent to raise as much as 495 million in an upcoming. Germany warns of many deaths as COVID infections hit new records. Do you know someone who has gone the extra mile during the pandemic.

The Wales international has had a stop-start time since returning to Spurs from Real Madrid Glenn Hoddle has urged Gareth Bale to go out and earn his opportunity at Tottenham but is unsure if the Welshman can do it as he has described him as looking tentative and fragile. As German car trading service Auto1 plans its IPO Sequoia and Lone Pine will each buy 50M shares from existing investors and put 50M into its IPO. The housing markets key metric just took an ugly turn for homebuyers.

Sequoia and Lone Pine will reportedly each buy 606M 50M in shares from existing investors in German car trading platform Auto1s IPO. Source Related News Sources.

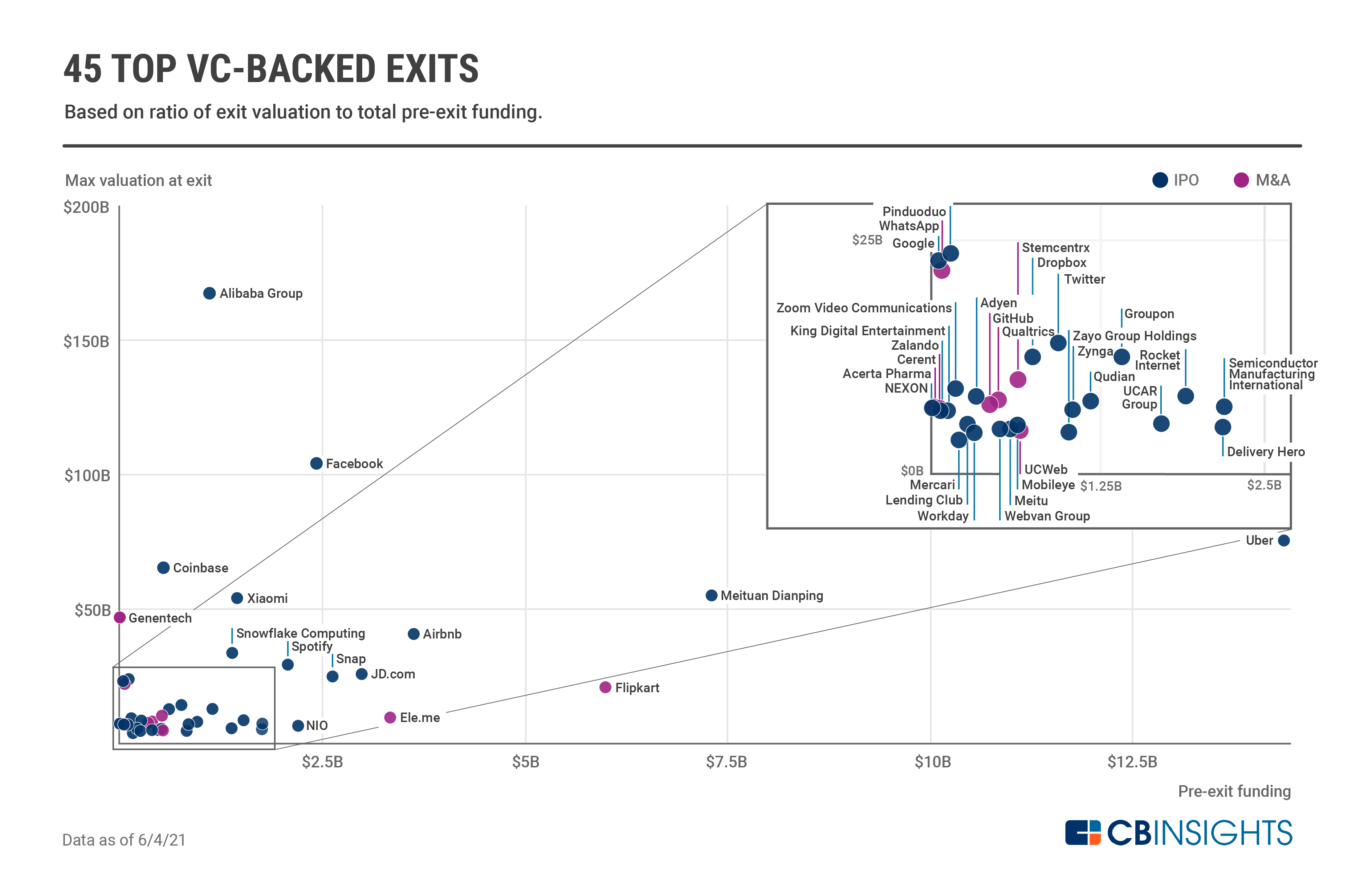

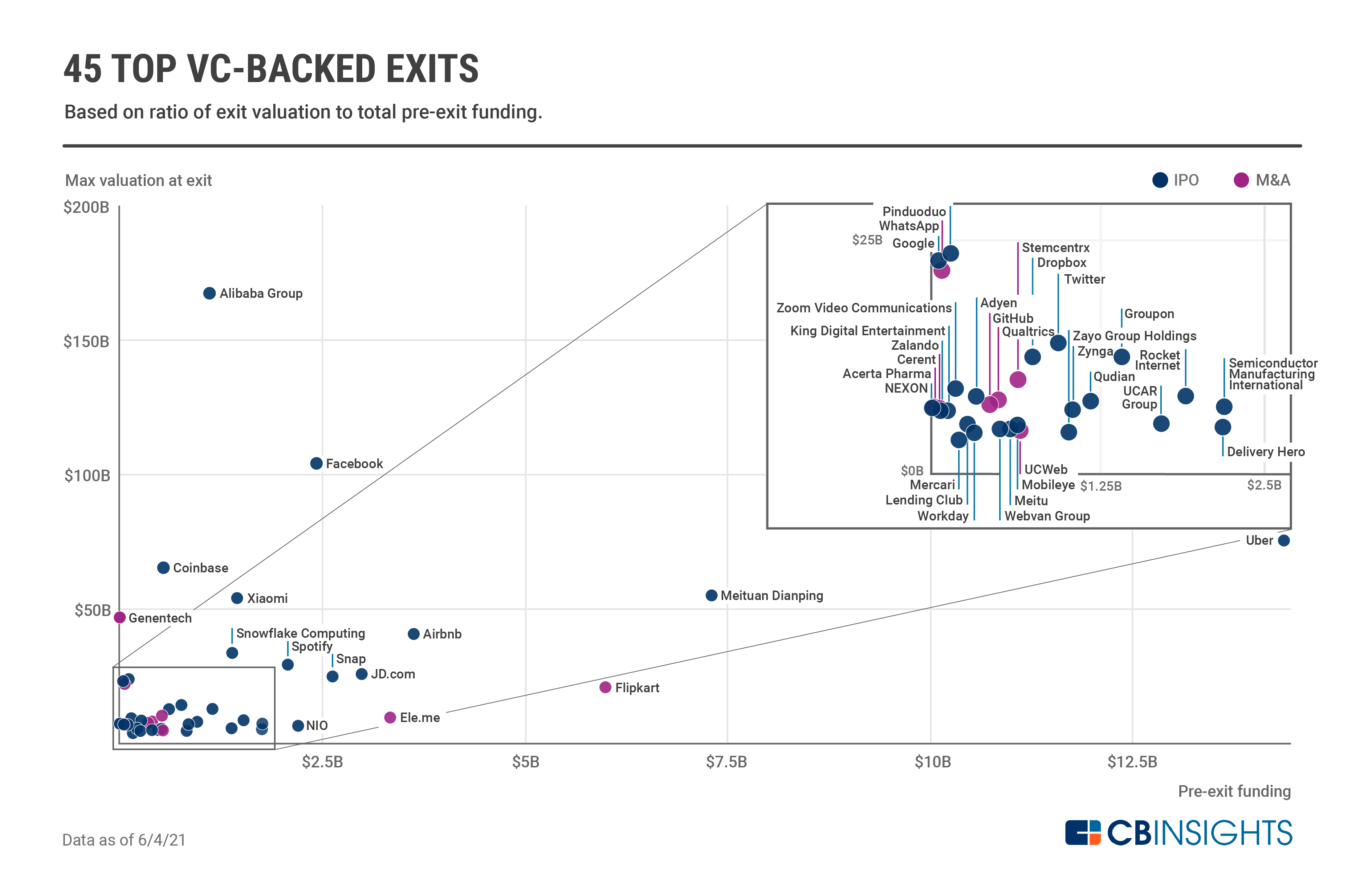

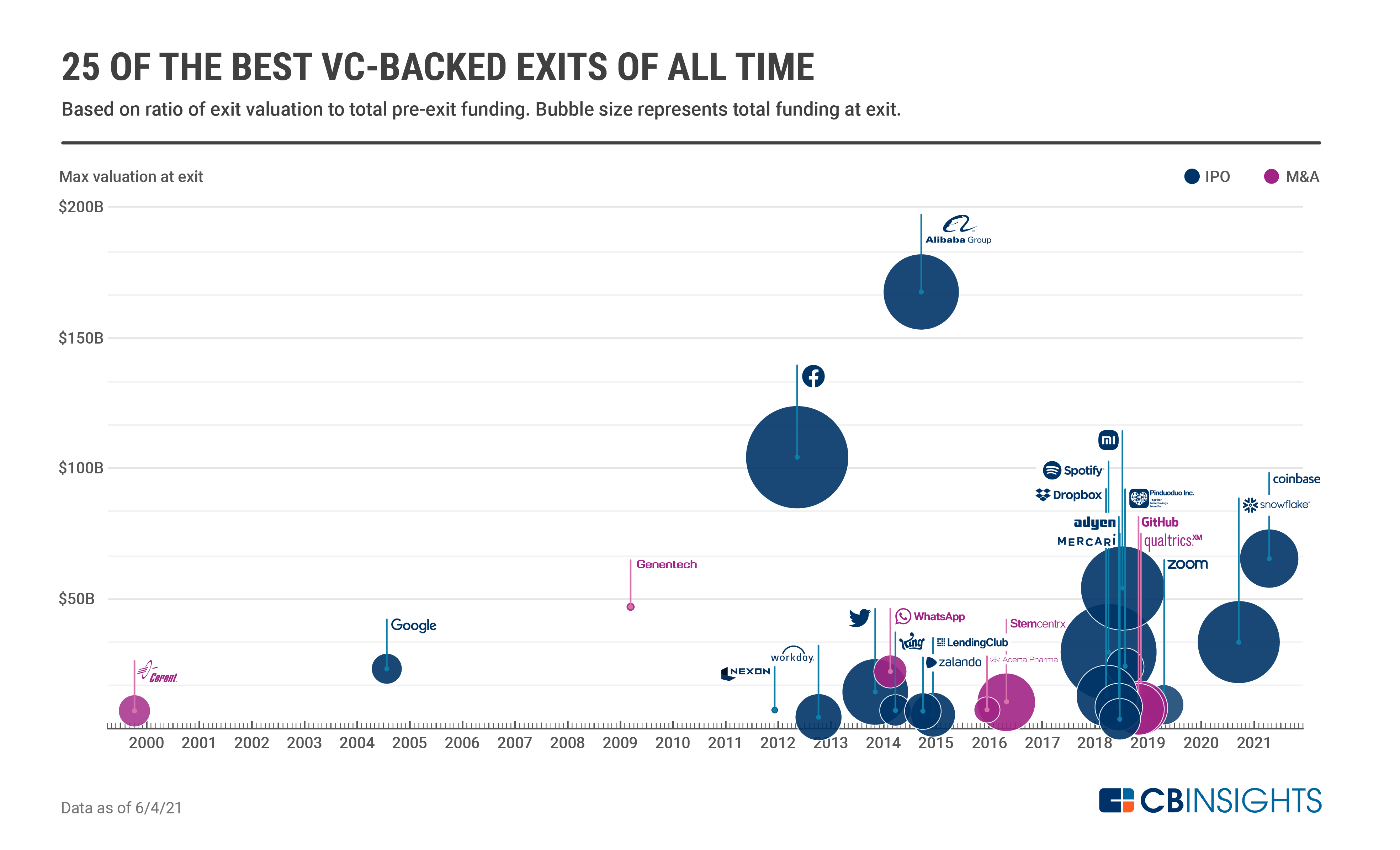

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

Sources Italy S Biggest Payments Company Nexi Is Leading Negotiations To Buy Its Nordic Rival Nets In An All Prepaid Debit Cards Stock Exchange Private Equity

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

Fed S Biggest Ever Bond Buying Binge Is Drawing To A Close Bnn Bloomberg

Pe Vc Investments Page 2 Gz Consulting

Bad News For Unicorns The Ipo Market Just Had Its Worst Quarter In 6 Years Fortune

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

0 comments

Post a Comment